Arc flash is a sudden, explosive release of energy from an...

ReadHave you ever wondered how energy storage can help to reduce the monthly bill of your power system? What about implementation? How big of a system is needed to maximize the benefits and make financial sense?

In recent years energy storage technologies, especially battery systems, have gained tremendous traction in the industrial and energy sectors. Beyond carbon reduction dividends, such systems offer tangible economic benefits, especially in environments with time-of-use (TOS) electricity rates, or net metering. In this article we explore, using a hypothetical example, how owners of large power systems like the ones in major oil fields, or industrial complex facilities, could unlock the financial potential of energy storage.

Untapping the potential of energy storage

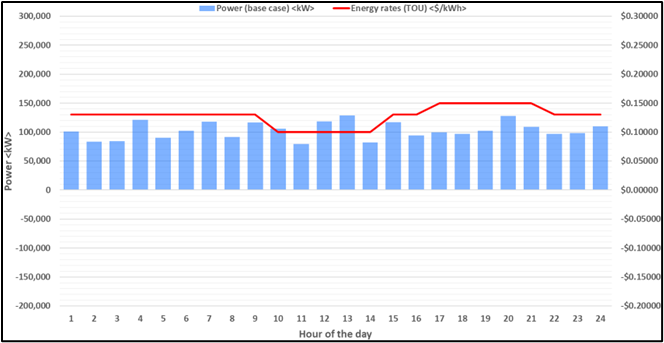

Let’s imagine a fictitious, energy intensive industrial complex that uses between 70 to 130 MW of power for its operation. Its monthly power consumption is billed against the following time-of-use (TOS) rates: peak hours $0.15/kWh, off-peak hours $0.13/kWh, and super-off-peak hours $0.10/kWh. A once-per-month charge for maximum demand would be applied at $32.95/kW. The next figure shows a one-day sample of the power profile, and rates per hour of such theoretical system.

A battery system capable of storing energy during the hours in which such energy is less expensive, and releasing it when it is more expensive (a practice called “energy arbitrage”), can substantially reduce the cost of the power bill. But how do you decide which hours, and the size of the system itself, for maximum gain? This is what is known in specialized literature as an optimization problem, for which a mathematical model can be used.

Optimizing the battery system for energy cost savings.

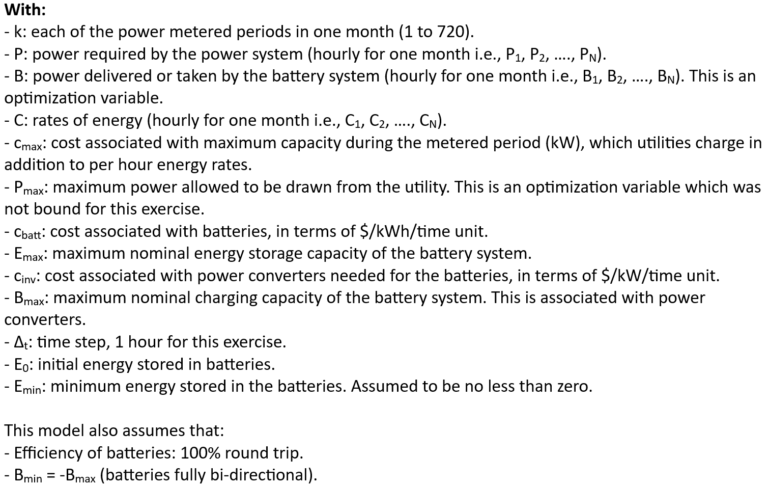

Assuming a typical market cost of a battery system of US$110/kWh, and the cost of the converters needed to connect them to the AC power grid at US$250/kW, a linear optimization model can be established. If you are interested in the math, you can find details of the optimization model and other parameters at the end of this article.

Solving the optimization model with the use of specialized engineering software (in this case Matlab), the objective of such optimization would be to decrease the facility’s monthly electricity bill as much as possible, while considering constraints like batteries not being discharged below zero, maximum and minimum charge / discharge rates within the power range of the facility and, for comparing scenarios with and without net-metering, no returns of power to the utility grid. The output of this optimization model is the per hour and maximum rates of charge/discharge of the battery system, its costs, its maximum energy storage capacity, and the cost of associated power converters.

Results

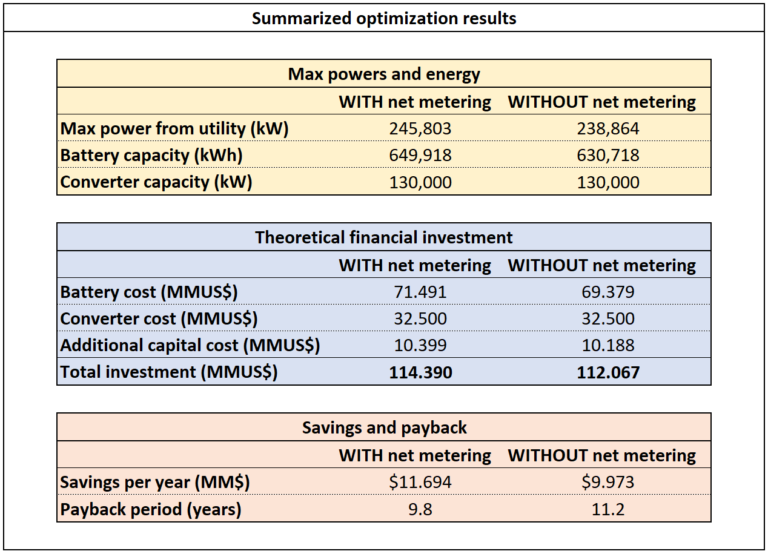

Two scenarios were considered, with and without net metering. Financial analyses assume undiscounted cash flows, and no carbon reduction incentives. The optimization results are as follows:

1- With Net Metering:

In environments where net metering is available, the system under study could not only draw from the battery system during peak hours, but could also feed excess energy back into the grid for credits. This results in potential savings of $11.7MM per year, assuming net-metering credits would be the same as energy rates during periods of power returning to the grid. With these savings, the payback period for the investment in the battery storage system is 9.8 years.

2. Without Net Metering

In areas where net metering is not an option, the system can still provide considerable savings by simply reducing the amount of peak power drawn from the grid. Savings here amount to $9.9MM annually, with a payback period of 11.2 years.

The estimated capital expenditure required for the optimized battery system of this hypothetical exercise would be between $112MM to $114MM, for both scenarios. Items like cost of land, engineering, utility capacity increase, and other related facilities were included as a flat 10% of the cost of batteries and converters, for simplification purposes. Compiled financial and technical results are presented in the next table:

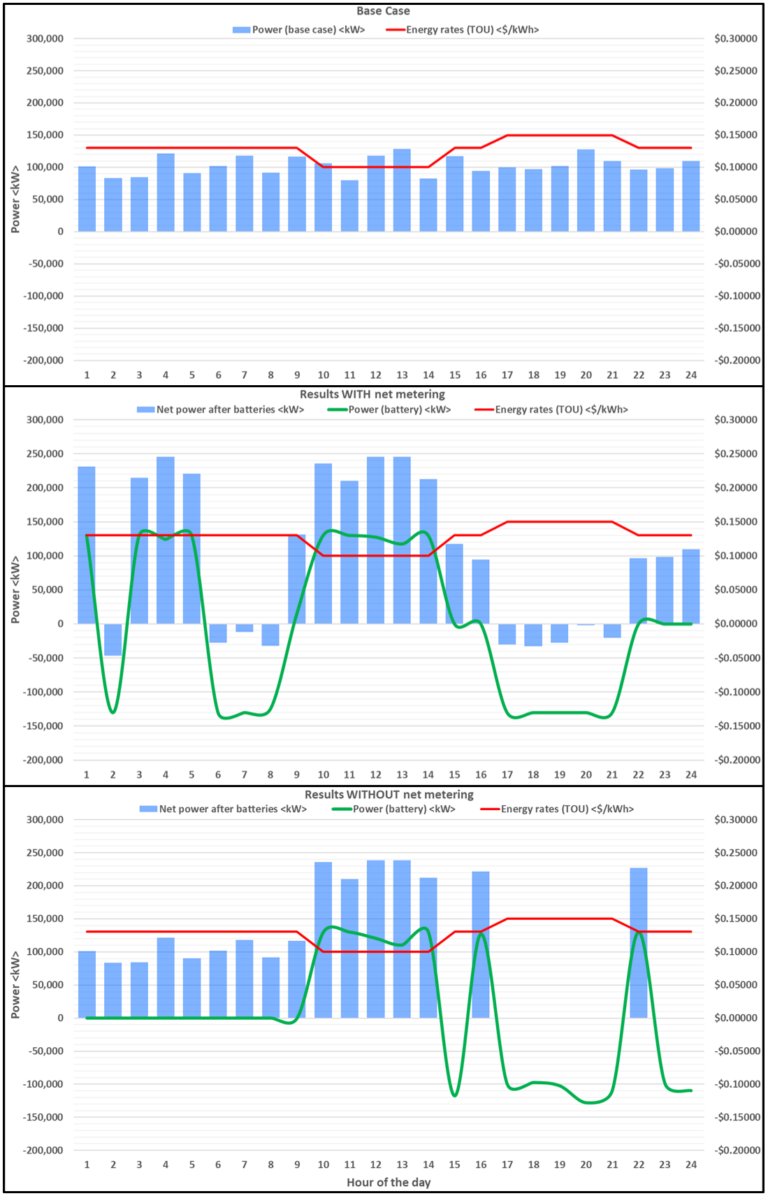

The next figure presents a one-day sample, vertical comparison of the base case (no batteries in the system), and the system with optimized batteries systems, interfacing with power grids with and without net-metering. Negative values in the bars mean power is being returned to the grid, while positive ones mean power is being drawn. The figure clearly indicates the optimization model favors charging the batteries during off-peak hours of the day (cheap energy), releasing such cheaply accumulated energy from the batteries to the grid during peak hours (expensive energy).

Takeaways

Despite the hypothetical nature of this example and its assumptions, the results are appealing. Even though your power system could be of different size, subject to different energy rates, or operate under different circumstances when compared with this example, it may be worth exploring energy storage. When implemented smartly, these systems can lead to substantial cost savings and potential carbon reduction benefits; the key lies in the careful planning and analysis of such implementations.

The world of energy storage is vast and nuanced. To truly harness the potential of these technologies, it is crucial to collaborate with engineers who possess a deep understanding of technical intricacies, project management, and financial analysis. The potential is there, but you must have the right team on your side to tap into it.

At Altus Dexter we pride ourselves on our holistic approach to energy solutions. We’re not just engineers, but financial analysts and project managers, ensuring that your energy storage solutions are not just technically sound but also financially optimal. Reach out to discover how we can help to optimize your power system, and assist you towards a carbon-reduced, more cost-effective future.

Recommended citation

Pineda, F., “Energy Storage: What It Could Mean (Financially) to My Electrical System”. Article (2023). Altus Dexter. www.altusdexter.com

References

[1] Olivieri, Zachary, “Optimization of Residential Battery Energy Storage System Scheduling for Cost and Emissions Reductions” (2017). Thesis. Rochester Institute of Technology

[2] Ariss, R., Buard, J., Capelo, M., Duverneuil, B., Hatchuel, A., “Cost-Optimization of Battery Sizing and Operation”. Technical Report. University of California

[3] Mathworks technical documentation, “linprog” function, https://www.mathworks.com/help/optim/ug/linprog.html

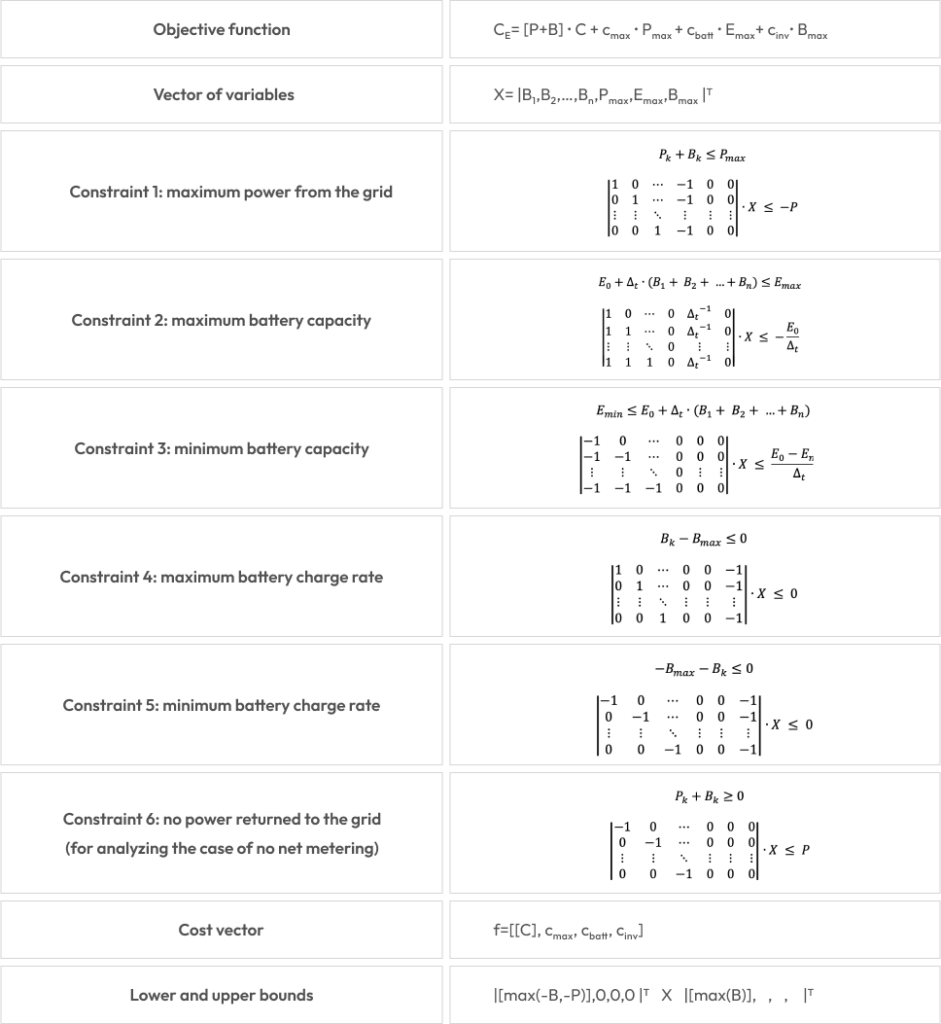

The math (in case you are interested)

This is the optimization model set-up for the example case presented in this article:

About the author

Fabian Pineda, P.E., is the Founder and Managing Director of Altus Dexter. He has extensive experience in project management, design, operation, reliability, and maintenance of electrical systems for industrial, oil, gas and offshore applications.

We also recommend

Electrical Reliability in Oil and Gas: A Study Case

In the high-stakes environment of oil and gas, electrical system reliability...

ReadCONTACT US

- (832) 773-1194

- info@altusdexter.com